Blogs

Chase obtained’t charges a fee every month because of it take into account up to five years when you’re also inside school, if you have a month-to-month direct deposit otherwise manage a daily harmony of $5,one hundred thousand or higher. Otherwise, you’ll spend $several to keep that it membership monthly. Taylor Tepper ‘s the previous lead financial publisher to own Usa Today Blueprint.Taylor’s previous spots are bride to be blogger ranking from the Wirecutter, Bankrate and money Mag. From the Money Magazine, Taylor contributed the brand new mag’s visibility from banking, investing and you can handmade cards.Taylor might have been wrote on the Nyc Moments, NPR, Bloomberg plus the Tampa Bay Minutes. Their performs has been acknowledged by his co-worker, winning an excellent Loeb, Due date Club and you may SABEW prize.Taylor gained a keen M.An excellent.

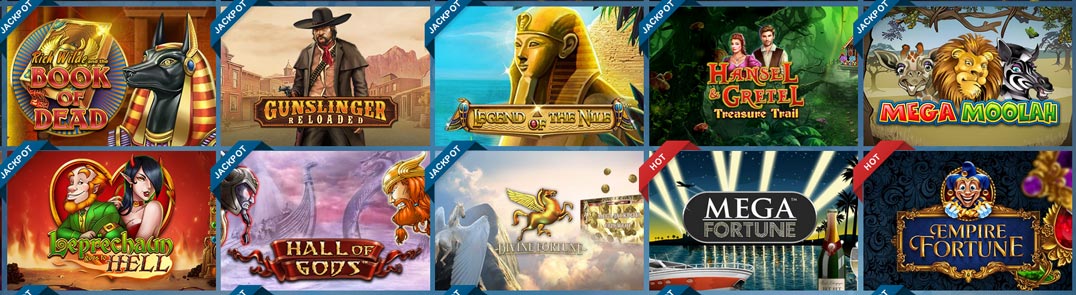

Partnerships Number: deal or no deal big win

There will be a good $step 3 percentage for each and every detachment in the a non-Chase Atm on the U.S. and the U.S. areas. $5 commission for each and every withdrawal in the a non-Chase Automatic teller machine outside the U.S. and the U.S. regions. U.S. territories is American Samoa, Guam, the new Northern Mariana Isles, Puerto Rico and also the U.S.

Greatest Family savings Bonuses of July 2025

Following see if the requirements to your added bonus in itself seem sensible. Its not all savings account bonus and family savings in itself was best for you, but if you discover an account that is a good fit, it could be a robust personal fund equipment. Being qualified purchases is debit card orders, ACH credits, Cord Import loans and you can debits, Zelle credits and you will debits, U.S. Most other deals such (yet not restricted to) other individual to Individual payments, transfers in order to credit card otherwise transmits anywhere between You.S. I’m Tony, a personal finance lover.If you’re looking to maximize the offers, I’ve got your safeguarded.

The new See Cashback Debit membership was a lucrative selection for people that appear to have fun with the debit credit. Which have cash return to the qualified purchases, you can secure much more than just you might having a typical bank account APY instead modifying your patterns at all. The point that Find did out with many well-known examining membership charge merely increases their attention. The newest Chase Company Over Banking membership try a small business family savings one lets you undertake mastercard repayments due to Pursue QuickAccept with no monthly package.

- Making the most added bonus amount offered by Chase demands making a good deposit with a minimum of $five hundred,one hundred thousand.

- Rating expert advice, actionable steps, and exclusive now offers that assist you save many purchase that have rely on.

- Nevertheless they discovered fee waivers on their account or other elite advantages.

- The amount may differ, but when you’re ready to discover an excellent Pursue membership, you’ll have to take a look at to find and therefore bonuses are being offered.

- Our very own co-maker Jeff Proctor, an old money expert, has used Robinhood in person and you will authored our very own complete Robinhood remark.

Wells Fargo Informal Checking

Repeated direct dumps and you may keeping a minimum balance are all conditions to own securing lender incentives. And, pay attention to the monthly restoration commission; through the years, these could without difficulty meet or exceed a single-date cash added bonus. Constantly, direct deposits visit a checking account at which you could potentially pay the bills, make transmits, or take care of your own personal fund matters; yet not, you could hook them up to possess deals profile, also. It provide is the best for people who can meet minimal equilibrium otherwise head deposit requirements to quit the fresh fee every month. The full Examining added bonus of Chase also provides a ratio out of bonus count versus minimal deposit demands.

You can make $fifty per referral just who opens up a great qualifying account—as much as all in all, 10 deal or no deal big win moments for every twelve months. The brand new family savings offers a monthly fee that’s broadening inside August, and you’ve got so you can dive thanks to hoops to avoid it — for example $five hundred inside monthly places or keeping significant balance. Meanwhile, of many on the web financial institutions never fees people monthly fees whatsoever, making Chase’s costs appear outdated and you may a lot of.

Discovered access immediately for the credit by the addition of they so you can an excellent digital wallet, such Apple Spend, Bing Spend™ or Samsung Spend. Observe how from the pursue.com/digital/spend-instantlyopens inside an alternative screen. For punctual, basic safer checkout just faucet to pay for which you discover the new Contactless symbol. To learn more, delight discover /contactlessOpens inside a different screen. Publication your traveling which have Pursue TravelSM for competitive prices and versatile a means to pay. You’ll not have to pay a yearly commission†Opens up prices and you will words inside the the fresh screen for your great have that come with the Freedom Unlimited credit.

Pursue Examining And you can Savings account Subscribe Incentive – Step-By-Step Instructions

Everything regarding Citi examining profile could have been gathered by the NerdWallet and contains maybe not been examined or provided with the brand new issuer otherwise merchant of this service or product. U.S. Lender previously offered a good $450 examining extra to possess beginning another membership. Because the financial has another account extra to be had, this site might possibly be upgraded on the details. More than 50 analysis items felt for every bank, borrowing union and you will financial technology company (or neobank) as eligible for our very own roundups.

From the Craig Newmark Scholar University from News media at the Area College or university of brand new York where he focused on organization revealing. There he had been given the brand new Frederic Wiegold Honor to own Company Journalism. The guy earned their undergraduate training from New york College or university.Taylor even offers done the education demands on the College out of Texas to be eligible for an authorized Economic Planner degree. People qualifying money can’t be away from established places, bonds and stuff like that. Samples of qualified accounts is actually qualifying Chase individual and you will checking accounts.

Checking account bonuses can be worth they once they fall into line having debt wants. For those who’lso are currently looking for a different bank account otherwise bank account, a plus might be a good extra to decide you to definitely financial over another. However, we wouldn’t suggest starting another membership just for the newest promo. The brand new Chase College or university Checking account is perfect for college students old 17 and you will 24. When you have research you’re also currently subscribed to college or university, you might steer clear of the $12 month-to-month maintenance payment for as much as 5 years. Or even, you’ll must set up a direct put or manage a great minimal every day harmony away from $5,000.

For many who’lso are given a welcome added bonus which have lead deposit requirements, you’ll need to investigate fine print otherwise consult a good support service associate prior to signing right up to your account. What counts as the a direct deposit during the one lender can vary from various other bank’s rules. Establish direct put and you can found at the least $5,one hundred thousand directly in deposits within this 60 days.

When you have Chase handmade cards, you might pay them online which have a primary import out of your Chase examining or savings account too. The brand new and you can translated account are not charged a month-to-month Service Payment for around the first a few report attacks. Following, the new Monthly Service Payment often apply if you don’t see among the methods to stop the newest Month-to-month Solution Commission per declaration period (in the event the applicable). New customers will enjoy a good $a hundred checking account bonus and you may possible very early access to head dumps. For individuals who’re also a concert economy side hustler such I am, you might have a method to meet with the lead deposit specifications.

If needed, contact support service in order to describe anything you’lso are being unsure of from the before signing upwards. If you would like put authorized signers on the account, they should be present in the membership beginning. Whenever they can’t be introduce, they’re pre-authorized during the membership starting, however, will need to visit the branch, having each other forms of ID, within thirty day period, getting signed up. Presenting several a means to shell out and now have paid off, such as centered-inside invoicing5 and you may card greeting, Zelle6, and you may Tap to invest to your iPhone7, to assist alter your earnings. You can purchase personal information and points from our party away from bankers. It’s just the expense of comfort combined with legacy banking.